Last week of May and that is probably the question that most hoteliers ask each other in the countries that remain under lockdown due to the Covid-19 pandemic.

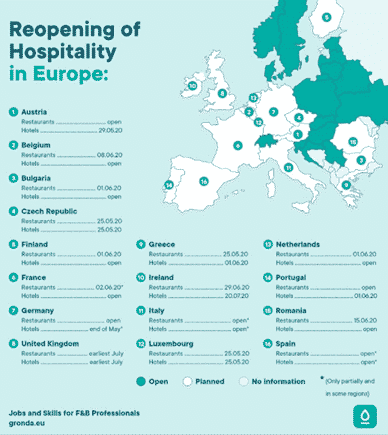

Restrictions are easing down in Europe (see below the latest update on this map, with the expected opening dates by country). However, even if those restrictions are lifted, many hotels are not opening yet.

Why? There are a mix of factors, with the main one being the lack of business. That is, prospect guests. Even if the law says “you are allowed to open”, if travel restrictions remain in place, or there are compulsory quarantine laws in place for the next few weeks…who is going to travel for leisure then?

Not many people can afford to spend 14 days locked at their destination when they reach it, plus another 14 back home once they return.

Domestic travel, winners and losers

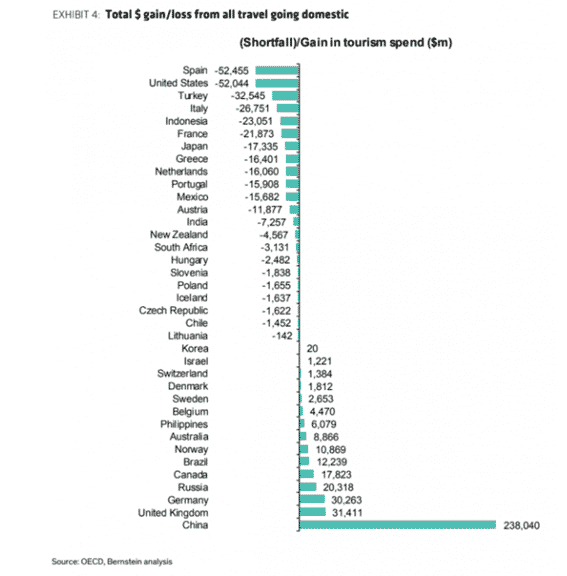

Therefore, with those travel restrictions in place, it’s all about domestic travel. And that is a tricky one, as it would theoretically benefit mostly the countries whose inhabitants traditionally travel abroad for their holidays.

In this study published by Skift, China, Germany and the UK would be the most benefited ones. However, I see this side of the study just theoretical because, at least when it comes to Germany and the UK, most citizens travel abroad in the search of better weather for their holidays. So, if they are to stay within their borders, I would question how many of them would enjoy the (caution, overused word) “staycation” and spend at home as much as they currently spend abroad.

Now, focusing on the other side of the chart, we see the countries that would lose the most if borders don’t open soon: Spain and the US top the chart with over $ 50 billion.

Actually, at least for Spain the amount could be almost double, as many hotels are seasonal, and if travel restrictions are not lifted before the summer, many would just don’t bother opening at the end of Q3. It would not make financial sense. I’ll get back to this point later.

The other top loser would be the US. And it’s curious because when one listens to American experts, they all currently boast about occupancies in Florida, how their hotels there are almost full lately. I can not question that, but what about the rest of the country? Last year the US received 80 million foreign tourists. So even if all Americans were to stay within their borders this year, they would be very far to make up for the loss of the international travellers.

Is it worth it?

For seasonal Hotels in the Mediterranean arch, which tend to open from Easter to end of September or October, the lift of the restrictions can not come early enough. However, as mentioned, it might already be too late.

They have to do their numbers, and calculate the volume of business they’ll have. And that also is challenging, as forecasting now, with nothing OTB (on the books), no trend for the last few months and nothing to compare to, is very complicated.

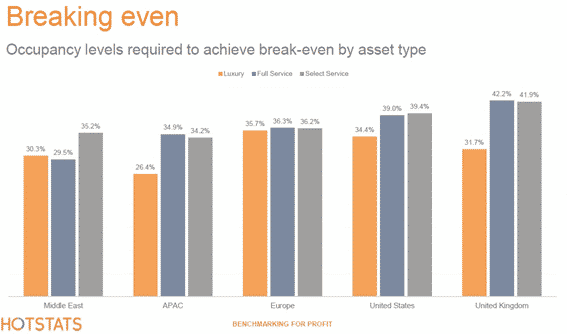

In any case, most hotels know what is their break even point. In a paper published by Hotstats this week, it shows that, globally, it sits on average at around 35 to 40% of occupancy.

And here comes the next big question: when will I reach that point?

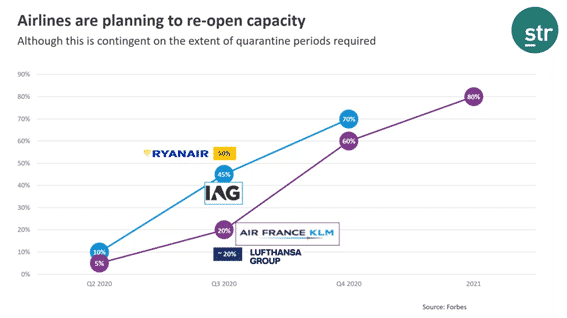

It all points into the same direction: the airline industry. Not only until the airlines are allowed to resume operations, will opening hotels make sense in most markets.

But for airlines, it’s the same challenge when it comes to lifting restrictions and break even point. The challenge for most of them is that their break even point is much higher than the Hotels’ ones. That is why they will (at least plan to) start operations slowly.

This graph published by STR and focused on the European airlines shows that most will ramp up operations from July, but at levels that go from the 20% of Lufthansa and Air France KLM, to the 50% expected from Ryanair. It will take until sometime in 2021 to get operations to levels pre-Covid.

Now, assuming those flights are full, that represents a 60-70% drop of people travelling around in the second half of the year. Which would be just about enough to reach the minimum break even point required by Hotels.

Reality, expectations and the daring

Going back to Hotel and reopening, there are basically 3 decision points:

-Reopen as soon as restrictions are lifted, because I believe is the right thing to do or because my owners force me to.

-Reopen when I believe it makes financial sense based on expected forecast. That is, I lose less money opening that being closed.

-Reopen only when I reach the break even point.

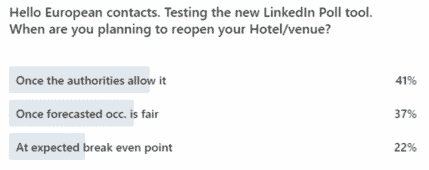

I’ve run a small mall this week on the new LinkedIn tool asking these questions. It’s not representative, but most people have responded that they’ll open either asap or when the forecast predicts it’s worth to do so.

There is a low number of respondents that believe they can hold it until they reach that break even point.

As you can see, it’s all a bit of chicken and egg now. Hoteliers, investors, owners…all looking at each other to see who makes the first move. Checking how things are going in other regions to do and redo numbers.

It will take some courage to go back to operations in these circumstances, but we all must agree this is a temporary thing. Investors have it clear, and they will continue pumping money into the industry. And that is reassuring.

Add comment